What Happens Next if You Choose to Break Your Lease?

What Happens Next if You Choose to Break Your Lease?

Blog Article

The rental market is always moving, with an increase of tenants than ever rethinking their residing situations. Searches about “can you break a lease” soared by over 70 % in the last year alone, showing a clear trend. Whether it's a job modify, unexpected financial difficulties, or a connection change, the decision to break a lease is not someone to take lightly. Knowledge the major facets at enjoy can help you save from sudden economic and appropriate headaches.

Early Terminations on the Rise

A current examination across key US cities exposed that around 18 percent of tenants consider breaking their lease before the entire expression ends. That mirrors broader changes in employment, life style, and even psychological wellness priorities. Information also demonstrates younger visitors, especially those outdated 18 to 34, are probably the most likely to produce a shift mid-lease. If you are in that party, you're definitely not alone.

Financial Penalties Prime the Record

The absolute most quick issue tenants have may be the economic impact. Study results suggest that 65 % of landlords charge some kind of early firing fee, which can range from the price of just one month's rent to the total rent remaining in your agreement. Around 28 per cent of tenants interviewed said they underestimated these prices, leading to shock costs that set straight back their budgets.

Concealed Costs and Other Expenses

It's not only about firing fees. Some landlords also withhold protection deposits or demand for re-listing the property. Normally, tenants can eliminate one more 20 per cent of their deposit if the apartment involves washing or repairs after an earlier exit. Understanding these numbers may help with decision creating before giving notice.

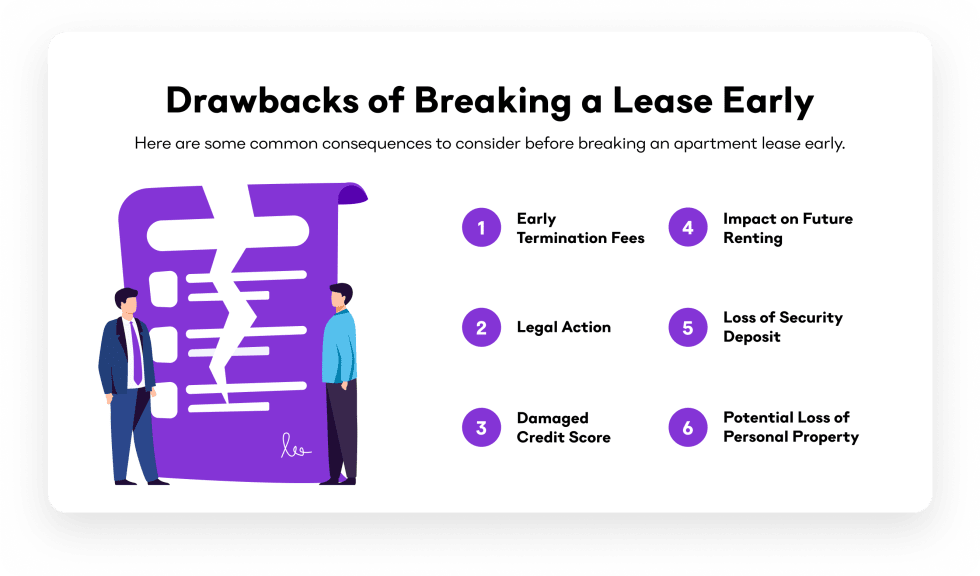

Legal and Credit Consequences

Breaking a lease may follow you in more ways than one. Almost 22 % of tenants who broke their leases without negotiating described a ding for their credit report. Landlords can deliver your unpaid balances to libraries, rendering it harder to lease elsewhere or secure loans. Also, being sued for unpaid book is a actual, if less common, risk.

Adequate Factors and Negotiations

Not all lease breaks are treated equally. Probably the most frequently recognized reasons contain health and safety violations, military deployment, or significant home injury from events like normal disasters. More than half of tenants polled properly negotiated with their landlords for a lowered cost or simpler terms once they presented documentation for such reasons.

The Interaction Element

Knowledge implies that visitors who communicated early and openly with their landlords were able to save your self typically 35 per cent on penalty costs. Placing expectations, discussing paperwork, and arranging for an upgraded tenant can all reduce the fallout. The earlier you start the discussion, the higher your chances to minimize fees and protect your credit score.

What the Trends Tell People

Lease-breaking is obviously trending upward. However, the risk of unexpected expenses and legitimate difficulty stays large for folks who don't approach ahead. Researching your lease agreement, understanding the great printing, and seeking legal advice if required are smart first steps.

Studying lease-breaking data can provide renters a sharper image of what's at share, which makes it better to consider their choices and prevent economic missteps. Being prepared and positive transforms what is actually a key setback right into a well-managed transition. Report this page